Expenses

Record, track, review, and bill expenses related to cases or matters.

How does the Expenses feature help?

The Expenses feature helps users record, track, review, and bill expenses related to cases or matters. It ensures better financial control, accurate client billing, and smooth approval workflows.

How the Expenses Feature Helps

1. Track All Expenses in One Place:

- Users can record billable and non-billable expenses.

- Expenses are organized under My Expense and Team Expense tabs.

- Helps maintain transparency and avoid missing expense entries.

How to Add an Expense

Record billable or non-billable expenses

Adding an Expense

Follow these steps to add an expense

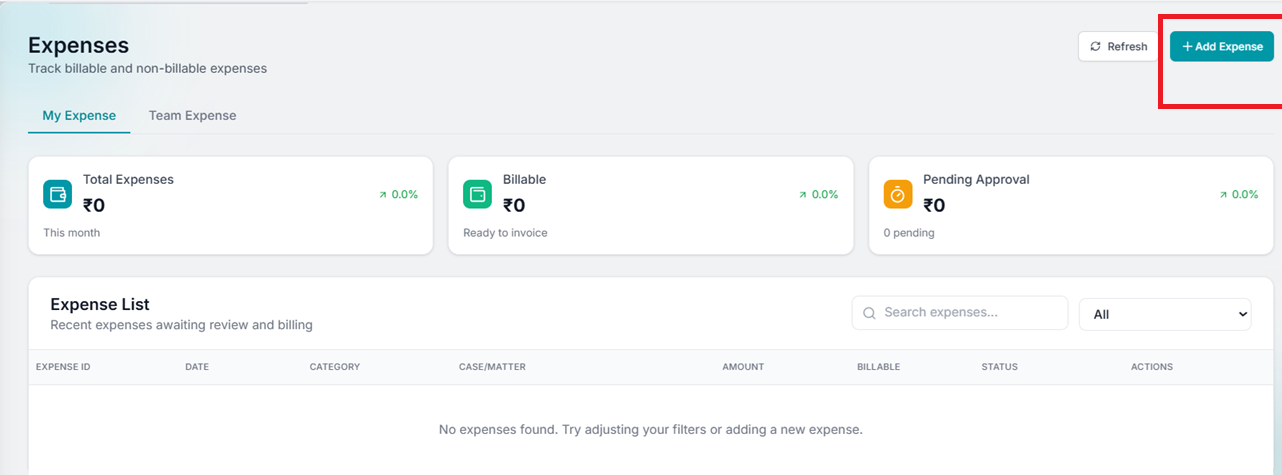

Navigate to Expenses

From the left-hand menu, click on Expenses. The Expenses dashboard will open showing: Total Expenses, Billable Expenses, Pending Approvals.

Click Add Expense

On the top-right corner of the page, click + Add Expense.

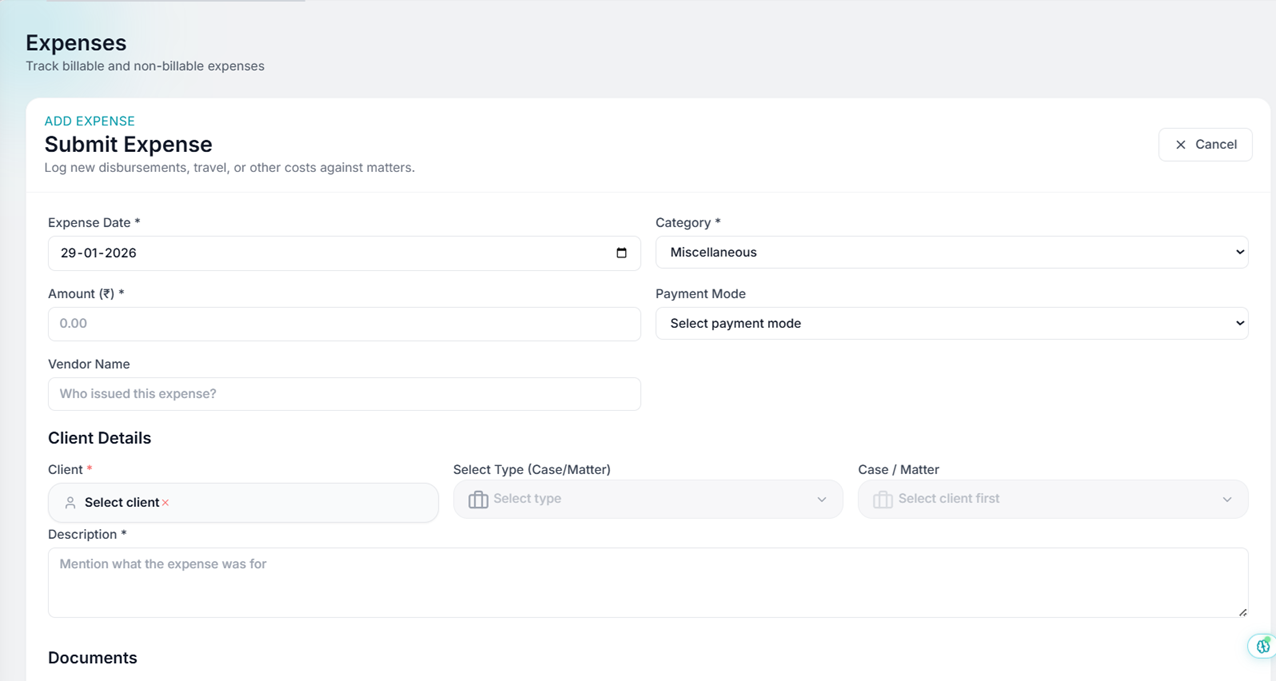

Enter Expense Details

In the Add Expense form, fill in the required fields:

Pro Tip

- Expense Date – Select the date of the expense

- Category – Choose the expense type (Travel, Filing, Internet, Telephone, etc.)

- Case/Matter – Select the relevant case or matter (if applicable)

- Amount – Enter the expense amount

- Client Details - Select the Client

- Billable – Mark whether the expense is billable or non-billable

- Description/Notes – Add any supporting details

- Upload Documents - Upload the supporting documents

Upload Supporting Documents (Optional)

Attach receipts or supporting files, if required, for approval or records.

Save the Expense

Click Save / Submit. The expense will be added successfully and appear in the Expense List.

Expected Outcome

Expense is successfully recorded and can be tracked, approved, and billed to clients if marked as billable.

You're all set!

Expense is successfully recorded and can be tracked, approved, and billed to clients if marked as billable.

How to Link Expense to Case

Associate expenses with cases or matters

Linking Expense to Case

Link expenses to specific cases for better tracking

Open Expense Form

When adding or editing an expense, locate the Case/Matter field.

Select Case or Matter

From the Case/Matter dropdown, select the relevant case or matter.

Save Changes

Save the expense. It will now be linked to the selected case or matter.

Expected Outcome

Expense is successfully linked to the case or matter and will appear in the case's expense list.